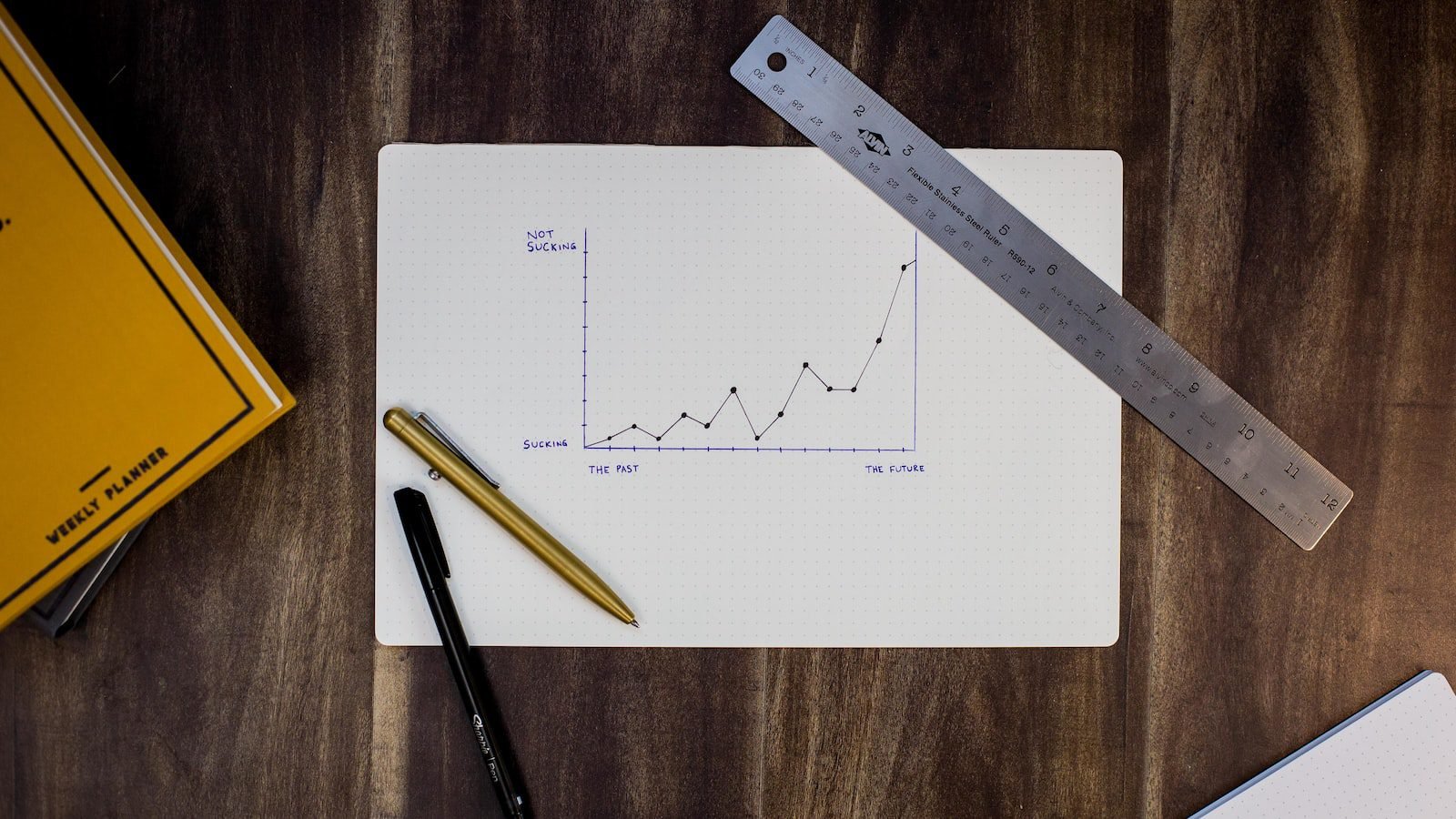

Tax Burden by State & Income: What You Need To Know

Tax Burden by State by Income looks at the total taxes paid by residents of each state, divided by their total earned income, to gauge the relative tax burden with which different states tax their citizens. This report takes into consideration a broad range of state taxes, including income, property, sales and other excise taxes. This analysis reveals the states with the highest and lowest effective tax rates for high-income households, as well as the impact of deductions, credits and exemptions on overall tax burden. It also looks at ways in which states structure their taxes to raise revenue while promoting economic growth.